The Internet empowers all of us to share content and media, express ourselves, and message our friends and family for free, regardless of borders, instantly and securely in many fun, delightful ways. Why is sharing money so different?

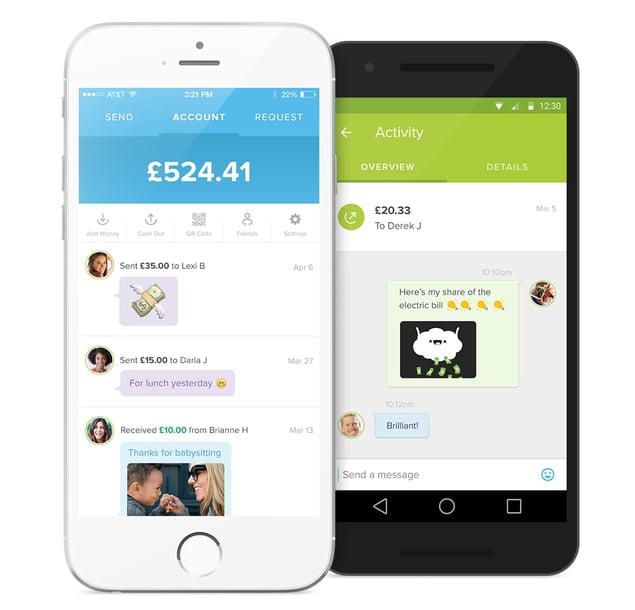

We don’t think it should be, and today UK citizens can take a step closer toward that new reality. People in the UK can now experience social payments over the open Internet in their native currency, pound sterling (GBP), using Circle’s updated apps for Android, iOS, and the Web.

Echoing our existing US dollar support (available in all US states), we’re also enabling people to make GBP payments that seamlessly cross currencies as needed -- instantly, and with zero fees.

Finally, we’re also eliminating transaction and withdrawal limits for customers in all of the 150+ countries where Circle is available.

UK Launch

When we founded Circle, we were inspired by a range of innovations -- including the birth of digital currency and distributed ledgers (e.g. blockchain tech), AI and machine learning, smartphone advancements, and cloud computing economics -- that were converging to make it possible (finally!) to change money and banking to work the same way nearly everything else already works on the Internet.

Similar inspiration struck many in the UK, and over the past year we’ve worked closely with such forward-thinkers in the UK government and banking sector to bring this new social payment experience to UK consumers.

As the first digital currency company in the world to be granted an E-Money license, Circle will also offer the benefits of digital money to Europe’s 500 million consumers, and ultimately enable anyone with sterling or euros to send and receive value for free and with an experience familiar to anyone who uses messaging or social media.

What is Circle? Why Social Payment Apps?

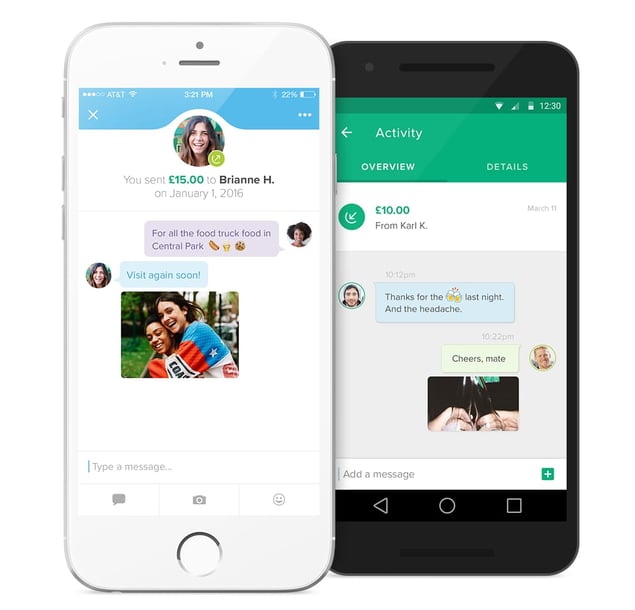

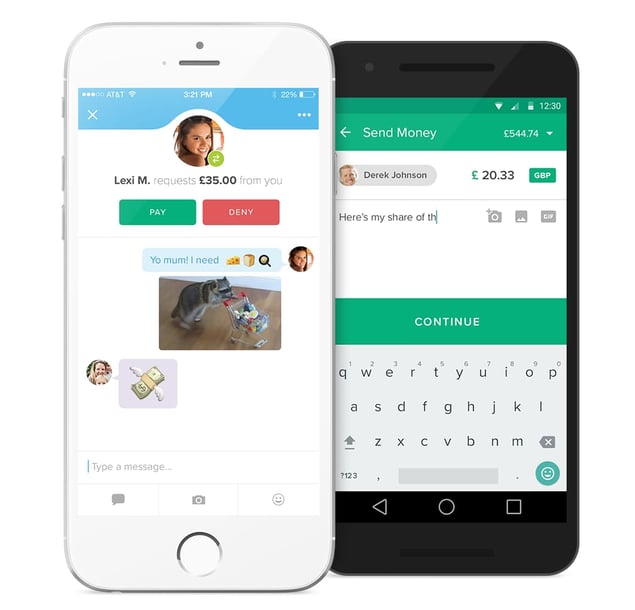

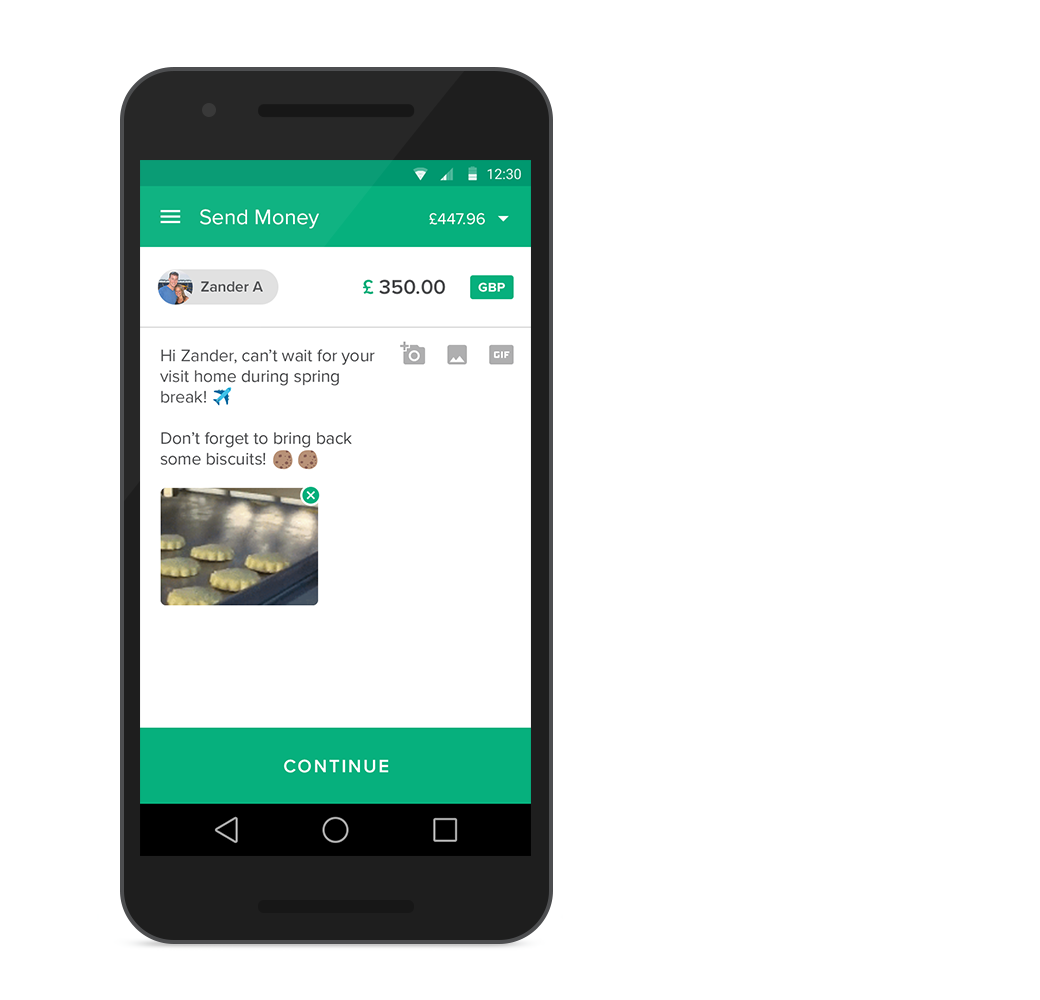

Through Circle’s social payment apps, consumers can share payments with and send money to friends, whether across the table or across the planet, with the speed, convenience, zero cost, and fun of the Internet.

Social payment apps are an emerging class of Internet services that empower people to share payments with friends and family. These apps (a) enable new creative expressions of value like gifting, (b) simplify debt and IOUs between friends and family, (c) eliminate the inconveniences of cash and cheques, and (d) smooth the pain of cross-border money transfer.

Typically, social payment apps provide a free service that allows customers to use their existing debit cards and bank accounts to send and receive personal payments; these apps often integrate payment behavior with social graphs, messaging, and media experiences. Examples of social payment apps include Circle, PayPal’s Venmo, Facebook Messenger Payments and WeChat Pay.

Money is inherently social and personal, wedded to life experiences and obligations and to the people in our lives -- our family, our friends, our colleagues, the associations and clubs we belong to, the businesses we are members of and interact with. Until recently, social and personal payments have been cumbersome, awkward, and highly local, unlike the Internet.

At Circle, we envision a new experience for money that builds on the experiences and possibilities we have with messaging, social media, and other forms of communication and information sharing that billions of people have become accustomed to online.

We don’t need bank branches; we have billions of smartphones as our distribution channel, our core product experience, and our customer service fulfillment channel. We don’t need to employ thousands of compliance staff; we build machine learning algorithms and financial artificial intelligence to reduce risk and improve the experience of money. We ship new releases of our “bank” every day and we’re constantly iterating on the consumer experience of digital money.

Money Without Borders

Part of making money work the way that the Internet works is overcoming the arcane, siloed systems of currencies and bank transfers that exist today, and making it work the same way that we send and receive email or browse the Web.

If we’re in the United States and want to send you some value, and you’re in the United Kingdom, or Ireland or Spain, why can’t we just text you the value, just like sending you a photo or a message? And why does someone have to charge a toll on that exchange? Google doesn’t strip out a few lines of text from emails as a fee when we send email around the world. Why can’t money move around without these costs and time delays?

When is the last time that you sent a “cross border email”, or conducted “an international Web browsing session”? The Internet knows no boundaries or borders; money is merely data and banks are regulated database operators. “Money Transfer” and “Payments” is nothing more than synchronizing data among these regulated database operators. With software and the Internet, we can make this so much better, faster, more secure and cost effective.

With Circle’s UK launch, we’re bringing this global vision another step forward. For the first time ever, any consumer in the US or UK can instantly send value, without fees, and with the convenience of sending an email or text. US dollars and pound sterling are becoming more digital and global, and we’re gearing up to bring the same capability to Euro-zone consumers.

An Open Internet of Value Exchange

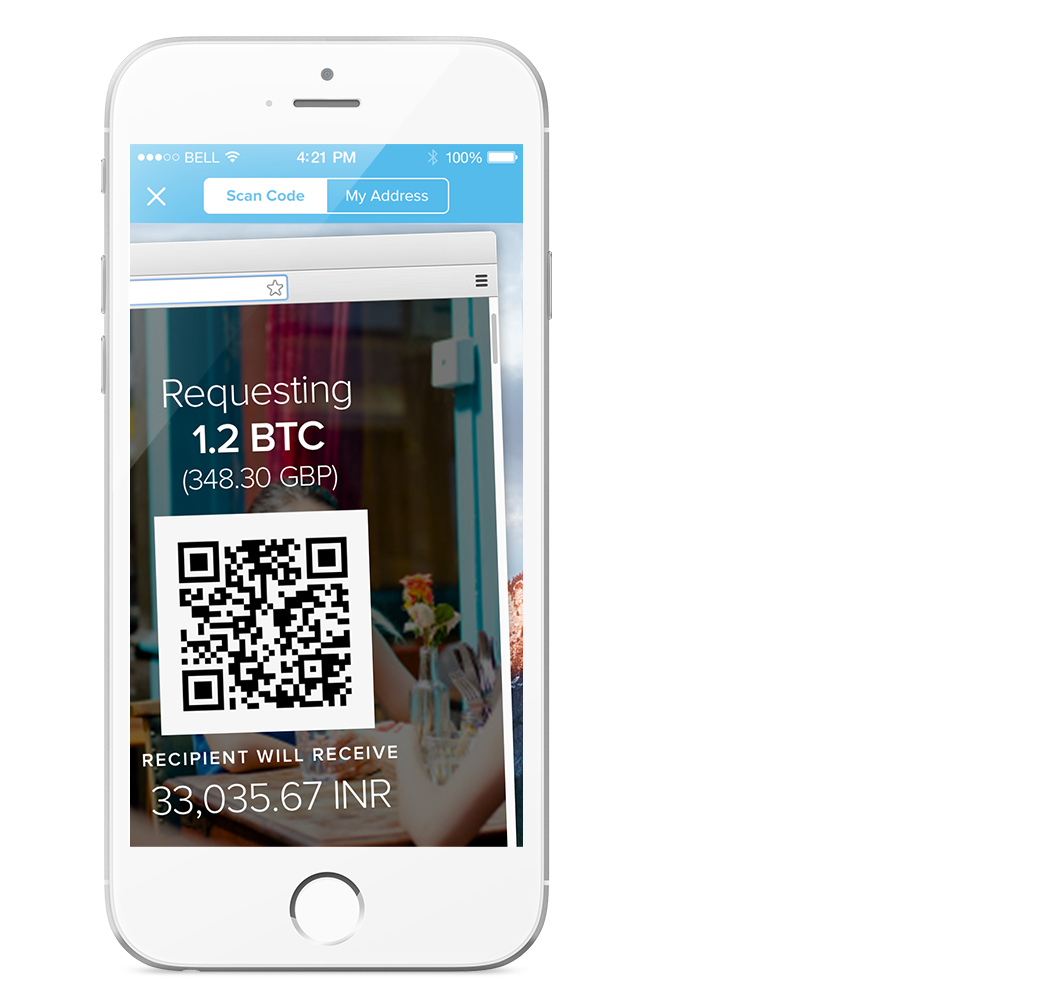

No one needs yet another closed transaction network. A critical element of Circle’s “money without borders” open value proposition is blockchain technology. Distributed ledgers and the protocols that support them are to payments what HTTP is to information sharing and media. Rather than creating more proprietary, closed, centralized networks, we’ve embraced the ideas that have fueled the digital age -- open networks, open intellectual property and open source software, distributed and decentralized information and computing architectures, and a fundamental respect for privacy and security.

We’d be thrilled if everyone in the world enjoyed Circle, but people benefit most if Circle is part of an open global network of value exchange with thousands of other software providers, online services, and financial institutions who are connecting to and innovating on public blockchains. We create network effects for one another, and grow the strength and resiliency of the system as a whole.

Circle allows UK and US consumers to transmit sterling and dollars over the blockchain, which means that Circle customers can send and receive value through thousands of other digital wallets and online money services, instantly and without fees. If you live in the UK and want to send pounds to someone, or receive value from someone in Japan, Korea, The Philippines, China, the US, Europe, Africa, etc., there are blockchain products and services in those markets that allow consumers to receive your payment instantly, and they can instantly convert it into their local currency and transfer it in and out of their existing bank accounts.

We’re in the early stages of blockchain technology. Bitcoin, ethereum, private chains, and new distributed ledger protocols will evolve, and a free and open experience with money will emerge. Circle is committed to accelerating this evolution and bringing the benefits to consumers around the globe.

Your View

Grab Circle Pay by visiting the Android or iOS store or by visiting the Circle Web app, start sharing money, and help us change the global economy via your thoughts and feedback!

Jeremy and Sean, Circle Co-Founders