Dollar digital currencies have been incredibly beneficial to the global crypto markets due to their ability to help reduce market volatility.

USD Coin (USDC) is the most stable cryptocurrency among dollar digital currencies, according to data compiled by research & analytics firm Flipside Crypto.

USDC: the Most Stable Cryptocurrency

In its report, Flipside Crypto demonstrates that USDC has the most reliable peg to the dollar on a 1:1 ratio as compared to other leading dollar digital currencies.

You may wonder what keeps USDC stable. In the case of USD, it manages to achieve price stability because each USDC is backed 1:1 by fully reserved dollar assets held in regulated US financial institutions. Additionally, every month, global auditing firm Grant Thornton attests to certain management assertions related to the total USDC in circulation.

The stability of USDC, along with its liquidity, speed and transparency, helped it become one of the fastest-growing dollar digital currency in the market, currently ranking as a top 10 digital asset by market capitalization.

USDC Drives Utility for Traditional Cryptocurrencies

Digital currencies like bitcoin (BTC) and litecoin (LTC) have often been criticized for not being able to offer true utility as currencies given their high volatility. While bitcoin can be used as a store of value, it struggles to function as a medium of exchange due to its volatility and high on-chain transaction fees.

Dollar digital currencies like USDC provide the price-stability needed for blockchain-powered digital value transfers that can be used for payments, remittances, trading, and more.

Dollar digital currencies can transform e-commerce and the global payments ecosystem, as blockchain transactions can be settled faster, more easily, and more securely compared to most fiat currency transactions.

USDC Empowers DeFi Projects

Another way in which stablecoins are impacting the crypto market is by ensuring liquidity and fixed prices in the decentralized finance (DeFi) market.

DeFi is gradually moving many segments of financial services, including lending, insurance, trading, asset management, and more to open blockchain infrastructure. Thus, these services are typically governed by communities rather than centralized third parties.

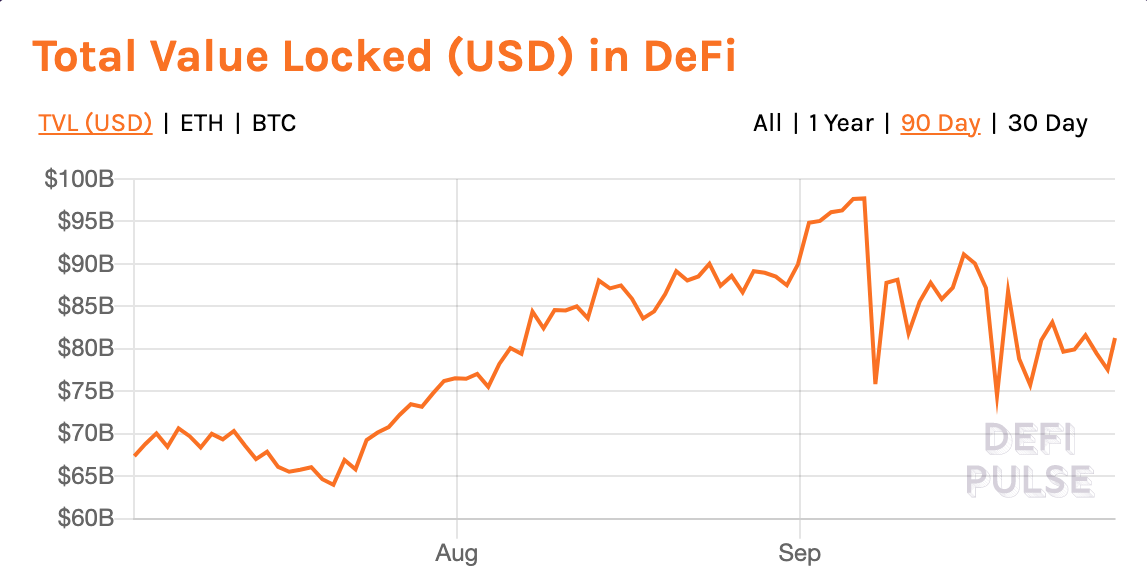

DeFi was the fastest-growing sector within the crypto industry last year, and it continues to grow. According to data from DeFi Pulse, there is currently over $84 billion worth of cryptocurrencies locked in DeFi projects.

USDC has emerged as the leading stablecoin in DeFi because it provides highly secure, high-speed transactions and price-stability that users can rely on.

Without dollar digital currencies, it’s likely fewer investors would have considered DeFi opportunities at all. If the only options are highly volatile assets, how can one facilitate lending services or achieve fair collateralization?

Stablecoins Help Traditional Investors Get Exposure to Cryptocurrencies

Cryptocurrencies have been attractive for investors for some time, but most institutional and professional investors have appeared reluctant to invest mainly because there were very few fiat gateways to access them in a secure manner.

Thanks to dollar digital currencies, the crypto market has become more accessible to both institutional, professional, and retail investors. USDC can be regarded as a bridge between fiat money and cryptocurrencies, making it easier to create and manage a crypto portfolio.

Dollar Digital Currencies Speed Up the Adoption of Digital Money

Dollar digital currencies like USDC have helped the concept of digital money finally begin to take shape. Bitcoin was initially designed as a peer-to-peer, digital money system. However, it failed to become a widely-used means of exchange because of its high volatility, increasing on-chain fees, and low adoption among merchants.

USDC represents a major breakthrough in how we perceive and use money. Circle CEO Jeremy Allaire said:

“Our core mission with USDC is to create a protocol for digital money that allows people to make value transfers over the internet as effortlessly as sending a text message or sharing content.”

USDC Ensures Liquidity in NFT Market

The most stable cryptocurrency, USDC, have also become a common currency in NFT (non-fungible token) marketplaces.

USDC addresses the volatility issue and benefits from the features of blockchain, pertaining to security and speed. Instead of buying NFTs with traditional cryptocurrencies whose prices can suddenly change, NFT users can convert their fiat holdings to USDC and feel confident they won’t lose value.

Circle recently announced the launch of a USDC-based payment solution designed for NFT marketplaces and storefronts. The end-to-end solution enables NFT marketplaces to accept credit cards as well as crypto payments. The new product will ensure more liquidity to the NFT space and thus boost its expansion.

Sign up for a Circle Account to start integrating USDC into your business today.